All Categories

Featured

Table of Contents

- – What Are The Top 10 Investment Blueprint Cours...

- – What Are The Top-Rated Courses For Learning Ab...

- – What Is The Top Course For Learning About Rea...

- – What Is The Most Valuable Training For Proper...

- – What Are The Most Effective Courses On Profi...

- – What Does The Financial Education Training I...

Any staying excess belongs to the owner of record immediately prior to completion of the redemption duration to be declared or designated according to law - overages strategy. These sums are payable ninety days after implementation of the act unless a judicial action is set up throughout that time by another complaintant. If neither claimed neither assigned within five years of date of public auction tax sale, the overage shall escheat to the basic fund of the governing body

386, Sections 44, 49.C, eff June 14, 2006. Code Commissioner's Note 1997 Act No. 34, Area 1, routed the Code Commissioner to alter all recommendations to "Register of Mesne Conveyances" to "Register of Deeds" anywhere appearing in the 1976 Code of Laws. AREA 12-51-135. Removal of mistakenly issued warrants. If a warrant, which has actually been filed with the staff of court in any type of region, is established by the Division of Profits to have been provided and filed in error, the staff of court, upon alert by the Division of Income, need to eliminate the warrant from its publication.

What Are The Top 10 Investment Blueprint Courses Available?

201, Part II, Section 49; 1993 Act No. 181, Area 231. The provisions of Areas 12-49-1110 with 12-49-1290, comprehensive, connecting to notice to mortgagees of suggested tax obligation sales and of tax obligation sales of residential properties covered by their particular home mortgages are adopted as a component of this chapter.

Code Commissioner's Note At the instructions of the Code Commissioner, "Areas 12-49-1110 via 12-49-1290" was replaced for "Areas 12-49-210 via 12-49-300" since the latter areas were rescinded. AREA 12-51-150. Official may void tax sales. If the official accountable of the tax sale finds before a tax obligation title has passed that there is a failing of any kind of activity needed to be appropriately executed, the official may void the tax sale and refund the amount paid, plus rate of interest in the amount really made by the region on the quantity refunded, to the effective bidder.

BACKGROUND: 1962 Code Section 65-2815.14; 1971 (57) 499; 1985 Act No. 166, Section 14; 2006 Act No. 386, Areas 35, 49. Code Commissioner's Note At the instructions of the Code Commissioner, the initial sentence as changed by Area 49.

BACKGROUND: 1962 Code Area 65-2815.15; 1971 (57) 499; 1985 Act No. 166, Section 15; 2006 Act No. 238, Area 3. B, eff March 15, 2006. SECTION 12-51-170. Agreement with area for collection of taxes due town. A region and municipality might contract for the collection of community tax obligations by the region.

What Are The Top-Rated Courses For Learning About Investor Tools?

He might use, select, or assign others to carry out or execute the arrangements of the phase. BACKGROUND: 1962 Code Section 65-2815.16; 1971 (57) 499; 1985 Act No. 166, Area 16.

Tax liens and tax actions usually sell for higher than the area's asking cost at public auctions. In enhancement, a lot of states have laws impacting proposals that go beyond the opening quote. Settlements above the county's criteria are called tax sale excess and can be profitable financial investments. The information on overages can create issues if you aren't mindful of them.

In this write-up we tell you how to get checklists of tax obligation excess and generate income on these assets. Tax obligation sale overages, also referred to as excess funds or exceptional bids, are the amounts bid over the starting price at a tax obligation public auction. The term describes the bucks the capitalist invests when bidding above the opening proposal.

What Is The Top Course For Learning About Real Estate Investing Recovery?

This beginning figure shows the tax obligations, charges, and interest due. The bidding starts, and several capitalists drive up the cost. After that, you win with a bid of $50,000. For that reason, the $40,000 rise over the original bid is the tax sale excess. Declaring tax sale overages implies acquiring the excess cash paid during an auction.

That claimed, tax sale overage cases have actually shared qualities across many states. Throughout this duration, previous owners and mortgage holders can contact the area and receive the excess.

What Is The Most Valuable Training For Property Claims Investors?

If the period ends prior to any kind of interested events assert the tax obligation sale overage, the area or state typically absorbs the funds. When the money mosts likely to the federal government, the possibility of asserting it disappears. As a result, previous owners are on a stringent timeline to insurance claim excess on their properties. While excess generally don't correspond to greater revenues, financiers can take advantage of them in numerous methods.

Bear in mind, your state regulations impact tax sale overages, so your state may not enable investors to gather overage rate of interest, such as Colorado. However, in states like Texas and Georgia, you'll earn passion on your whole quote. While this aspect does not suggest you can assert the overage, it does assist mitigate your costs when you bid high.

Remember, it may not be lawful in your state, implying you're restricted to accumulating passion on the overage - recovery. As mentioned above, an investor can find means to benefit from tax sale excess. Because rate of interest earnings can relate to your whole quote and previous proprietors can declare overages, you can leverage your knowledge and devices in these situations to make best use of returns

As with any investment, research is the crucial opening step. Your due diligence will certainly supply the essential understanding right into the residential properties available at the next public auction. Whether you make use of Tax obligation Sale Resources for investment information or call your area for info, a detailed examination of each building allows you see which homes fit your investment design. An essential facet to keep in mind with tax sale overages is that in many states, you just require to pay the region 20% of your total bid up front. Some states, such as Maryland, have laws that go past this guideline, so once again, study your state laws. That stated, most states follow the 20% regulation.

What Are The Most Effective Courses On Profit Recovery?

Instead, you only require 20% of the bid. If the property doesn't retrieve at the end of the redemption duration, you'll require the remaining 80% to get the tax deed. Due to the fact that you pay 20% of your proposal, you can make rate of interest on an overage without paying the full rate.

Once more, if it's legal in your state and region, you can deal with them to aid them recover overage funds for an added fee. You can accumulate rate of interest on an overage quote and bill a cost to improve the overage claim process for the previous owner. Tax obligation Sale Resources lately released a tax obligation sale excess product particularly for people interested in pursuing the overage collection company.

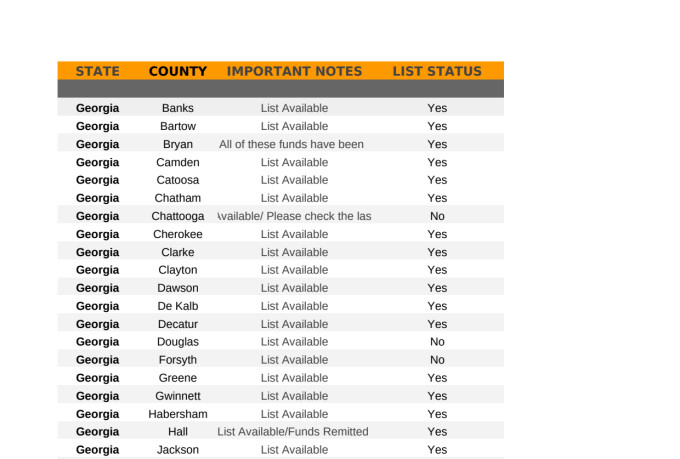

Overage collection agencies can filter by state, area, home kind, minimum overage quantity, and maximum overage amount. When the data has actually been filteringed system the enthusiasts can determine if they want to include the skip traced data plan to their leads, and afterwards pay for only the verified leads that were located.

What Does The Financial Education Training Include?

In enhancement, just like any kind of other investment approach, it provides distinct pros and disadvantages. asset recovery.

Table of Contents

- – What Are The Top 10 Investment Blueprint Cours...

- – What Are The Top-Rated Courses For Learning Ab...

- – What Is The Top Course For Learning About Rea...

- – What Is The Most Valuable Training For Proper...

- – What Are The Most Effective Courses On Profi...

- – What Does The Financial Education Training I...

Latest Posts

Auction Of Tax Sale Property

Tax Foreclosed Property

Surplus Monies

More

Latest Posts

Auction Of Tax Sale Property

Tax Foreclosed Property

Surplus Monies